Detailed Notes on Do I Have To List All My Assets and Debts When Filing Bankruptcy?

Bankruptcy wipes out a lot of bills, like bank card balances, overdue utility payments, health care expenditures, personalized financial loans, and much more. You can also dispose of a mortgage or auto payment for anyone who is inclined to give up your home or car or truck that secures the debt.

The equilibrium with the charges are compensated to us from the trustee (out of your prepare payments, certainly) inside of a manner just like the best way that your other creditors receives a commission.

Every article that we publish has actually been prepared or reviewed by one among our editors, who alongside one another have over one hundred many years of experience working towards law. We strive to maintain our facts existing as laws transform. Find out more about our editorial expectations.

Debt consolidation might help improve credit score if it can help a person make payments punctually even though also minimizing the amount of cash owed on different accounts.

You will have to have plenty of money in chapter thirteen to pay for to your necessities and to maintain up With all the required payments as they come due. (see Virginia Chapter 13 bankruptcy)

No, a lot of dependable tax reduction companies supply precious products and services to taxpayers who will be struggling with taxes. Nevertheless, there are numerous lousy apples, as in each individual industry, that give the rest a nasty identify.

The reality that you’ve submitted a bankruptcy can show up on visit the site your own credit document for ten decades. But since her latest blog bankruptcy wipes out your previous debts, you're very likely to be in a greater position to pay your recent payments, and you also could possibly get new credit score.

You can expect to file the creditor matrix in addition to your other bankruptcy paperwork. Just about every bankruptcy courtroom has policies and techniques for preparing and filing the creditor mailing list.

By publishing this form I my response conform to the Conditions of Use and Privacy Policy and consent to generally be contacted by Martindale-Nolo and its affiliate marketers, and up to a few Lawyers relating to this request and also to obtaining related promoting messages by automated implies, textual content and/or prerecorded messages within the range presented. Consent will not be essential being a condition of services, Click the link

You'll be able to drive secured creditors to get payments after a while inside the bankruptcy process and bankruptcy can reduce your obligation to pay for any extra dollars When your residence is taken. Nevertheless, you typically simply cannot maintain the collateral Except if you continue on to pay the financial debt

This read what he said chapter of the Bankruptcy Code provides for "liquidation" - the sale of the debtor's nonexempt house along with the distribution on the proceeds to creditors.

Yet another variety of personal debt pop over to this site consolidation offers a fixed-rate private mortgage during which borrowers use the money from your bank loan to pay off debts just before paying out back the loan in installments Based on new conditions. Does credit card debt consolidation have an affect on credit score?

When filing for bankruptcy, disclose all of your assets, Regardless how trivial you think They are really. Err over the side of about-disclosure as an alternative to attempting to cover assets.

We sustain a firewall among our advertisers and our editorial team. Our editorial workforce won't obtain immediate payment from our advertisers. Editorial Independence

Charlie Korsmo Then & Now!

Charlie Korsmo Then & Now! Destiny’s Child Then & Now!

Destiny’s Child Then & Now! Heather Locklear Then & Now!

Heather Locklear Then & Now! Pierce Brosnan Then & Now!

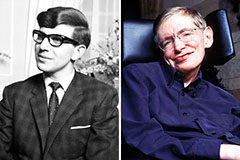

Pierce Brosnan Then & Now! Stephen Hawking Then & Now!

Stephen Hawking Then & Now!